UBO compliancy in the Netherlands: the crucial role of share registers

UBO register compliance is more than ticking a regulatory box: it’s about transparency, trust, and governance.

Accurate share registers form the backbone of UBO identification.

They capture ownership details, voting rights, and effective control, giving companies, organisations and associations a complete view of their ownership structures.

Corporify explains why robust share registers are critical for UBO compliance and corporate governance.

UBO register Netherlands: what is it and why does it matter for your business?

The UBO register in the Netherlands lists UBOs for companies and legal entities, helping combat tax fraud and money laundering. Submissions require validation by an authorised signatory to ensure compliance.

Organisations must provide accurate information, ensuring the register tracks ownership structures and helps regulators spot suspicious activities.

From historical legal entities to cooperative societies: which legal entities are required to register UBOs?

Dutch law requires UBO registration for several legal entities, including private limited liability companies, public limited liability companies, European economic interest groupings and associations, and European cooperative societies.

Details must be submitted to the Chamber of Commerce, and historical legal entities must also keep UBO records. Failing to comply can lead to fines, reputational damage, and regulatory investigations.

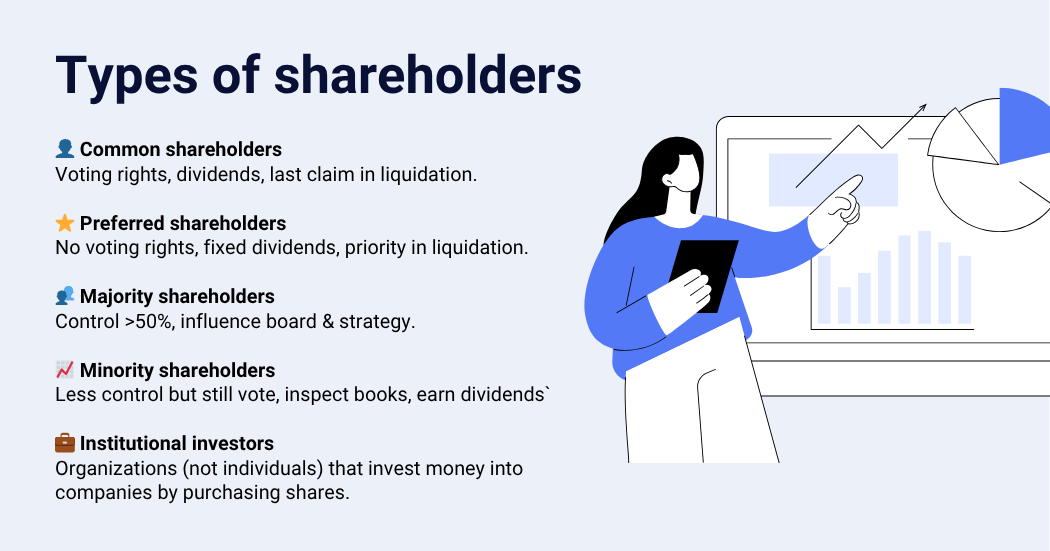

The share register’s role in UBO identification

For private limited liability companies, public limited liability companies, and limited partnerships, accurate share registers provide clarity on ownership, voting power, limited legal capacity, and control.

They help companies pinpoint ultimate beneficial owners and maintain clear audit records.

What details do companies need to submit to the UBO register?

The UBO register requires the following information:

- Full name, nationality, and home address of UBOs, which include both legal entities and natural persons.

- Citizen service number or tax identification number

- Ownership percentage and extent of control

- Supporting documents, such as a confirmation letter from a civil law notary, and ensuring compliance with the correct legal form requirements.

The UBO register and risks of non-compliance

UBO information is submitted to the Chamber of Commerce, often with supporting documents to verify ownership and control. However, errors in these documents may result in a request for corrections.

Non-compliance has serious consequences: the Financial Intelligence Unit may investigate, particularly in cases of suspected money laundering.

Moreover, companies and organisations that fail to remove individuals who are no longer UBOs may face steep penalties, including fines and legal action.

Further, companies and organisations that fail to remove individuals who are no longer UBOs may face steep penalties, including fines and legal action.

Who can access UBO data?

Viewing UBO data is limited to authorised organisations, such as tax authorities, with public law safeguarding personal privacy. Companies must ensure every person handling UBO records is authorised and trained in data security.

In addition, organisations should maintain strong security measures, designate a responsible individual, and keep robust compliance policies in place.

When individuals are no longer UBOs, organisations must act promptly to deregister persons, preserving the accuracy and integrity of their records.

UBO register obligations for trusts, partnerships, and associations

The UBO framework extends beyond companies, covering UBO register trusts, limited partnerships, general partnerships, and various associations.

This ensures comprehensive transparency across a wide range of structures. To maintain compliance, all owners and every person with significant ownership or control must be clearly identified and properly recorded, including all relevant natural persons.

Keeping UBO register accurate and verified

Companies operating across multiple EU countries should register UBOs consistently to align with Dutch and EU standards.

Each person with significant ownership or control must be recorded accurately to ensure compliance. Cross-border compliance helps businesses avoid regulatory issues and demonstrate adherence to international transparency norms, regardless of the country they operate in or the organisations involved.

Corporify's checklist for strong UBO compliance

How can organisations ensure their UBO register and processes are compliant?

Following these best practices will help you maintain transparency and meet regulatory obligations.

#1. Maintain share registers that detail every person identified as an ultimate beneficial owner and those with limited legal capacity. Properly register UBOs to ensure accuracy and keep records clear for all significant owners.

#2. Use digital tools to streamline UBO registration, improve accuracy, and reduce errors, ensuring that each person involved in the process is accounted for and correctly recorded.

#3. Conduct regular internal audits for entities, including general partnerships, to uncover discrepancies and maintain accurate UBO records.

#4. A civil law notary verifies ownership structures, authenticates submissions, and ensures UBOs are properly identified, with authorised signatories validating Dutch compliance requirements.

.png?width=750&height=394&name=Copy%20of%20Organic%20Social%20Media%20Templates%20(2).png)

Share registers: the key to ultimate beneficial owner compliance

The UBO register helps to combat financial crime, but it’s the share register that truly reveals who owns and controls a business.

By tracking ownership, voting power, and control, share registers ensure clear, reliable, and transparent UBO identification, which is critical for trust and compliance.

Corporify’s expert tools keep share registers accurate, secure, and compliant, making UBO management simple and efficient. Visit the Corporify website to learn more about keeping your business compliant, organised, and audit-ready.